Sen. Ron Johnson, R-Wis., perhaps the Senate’s fiercest fiscal hawk, has released a lengthy report on the “big, beautiful” budget reconciliation bill, claiming the bill would balloon deficits.

The big, beautiful bill is a ten-year fiscal plan that would fulfill many of President Donald Trump’s campaign promises, such as extending his 2017 tax cuts and funding border security.

Johnson told The Daily Signal on a press call that he completely supports “most of the big elements” in the bill, but that ”it’s just not adequate to the task in terms of addressing the long-term debt deficit issue.”

Johnson’s report is a daring counteroffer to a bill that the White House and congressional leadership are dying to get passed.

Senate leadership is hoping to pass the bill by July 4, but Johnson says that the bill must return to a pre-COVID level of spending in order to avert a debt crisis, precipitated by rising interest rates and the devaluation of the dollar.

The 30-page report takes inspiration from a 2011 tweet in which Trump said, “Washington has a spending problem, not a revenue problem.”

This has become almost a mantra for Johnson.

“Fueled by spending that levels that exploded during the pandemic but never receded, our fiscal situation is far worse than when President Trump posted that tweet in 2011,” writes Johnson.

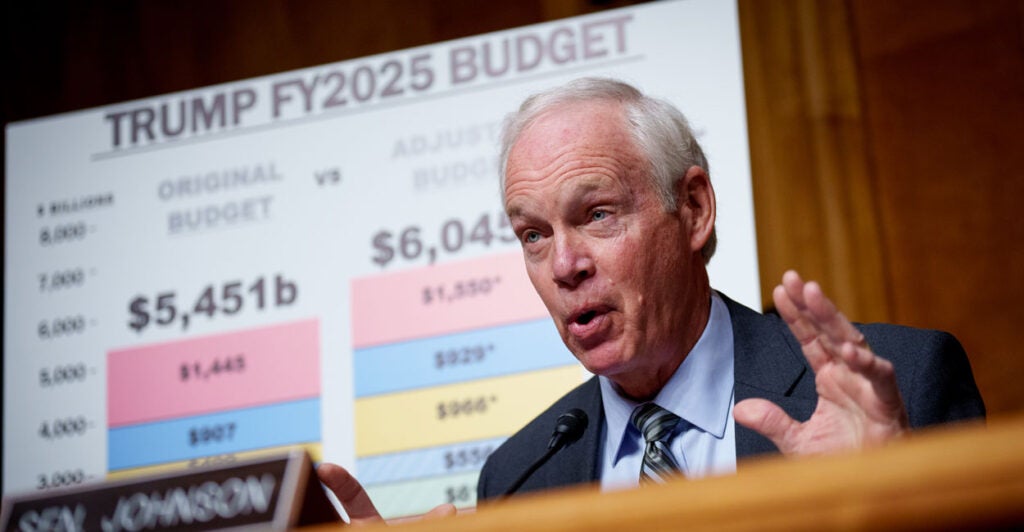

If there’s one thing the Wisconsin Senator loves, it’s graphs. He created the immigration chart which Trump turned his head toward at the moment of the Butler, Pennsylvania assassination attempt.

Johnson’s report is essentially a rebuttal of Republican congressional leadership’s claims that the deficits projected by congressional watchdogs will not materialize, because tax breaks will stimulate growth.

In response, Johnson maps out a few scenarios of growth.

Growth Scenarios

Johnson predicts, based on the Congressional Budget Office’s figures, that the big, beautiful bill, if enacted, would lead to a $24.1 trillion deficit over 10 years, assuming 1.8% average GDP growth. This would be unacceptable to him.

Leadership in both chambers have scoffed at the CBO’s projections, arguing that the congressional economic analysis organization is biased against tax breaks and that they underestimate growth.

If this growth is ratcheted up 2.2%, however, the ten-year deficit would be $22.6 trillion, Johnson says in his report.

With average annual growth bumped up to a healthy 3%, this deficit drops to $20.2 trillion. This still is not good enough for Johnson.

For context, Secretary of the Treasury Scott Bessent has set 3% growth as his goal by 2028, but Johnson argues that even this would not make up for losses from tax breaks.

“It is a worthy goal, and economic growth is a key component to restoring fiscal sanity,” Johnson writes. “But as the chart above shows, absent spending reductions, 3% growth only begins to flatten the deficit curve, it does not bend it down on a trajectory toward balancing the budget.”

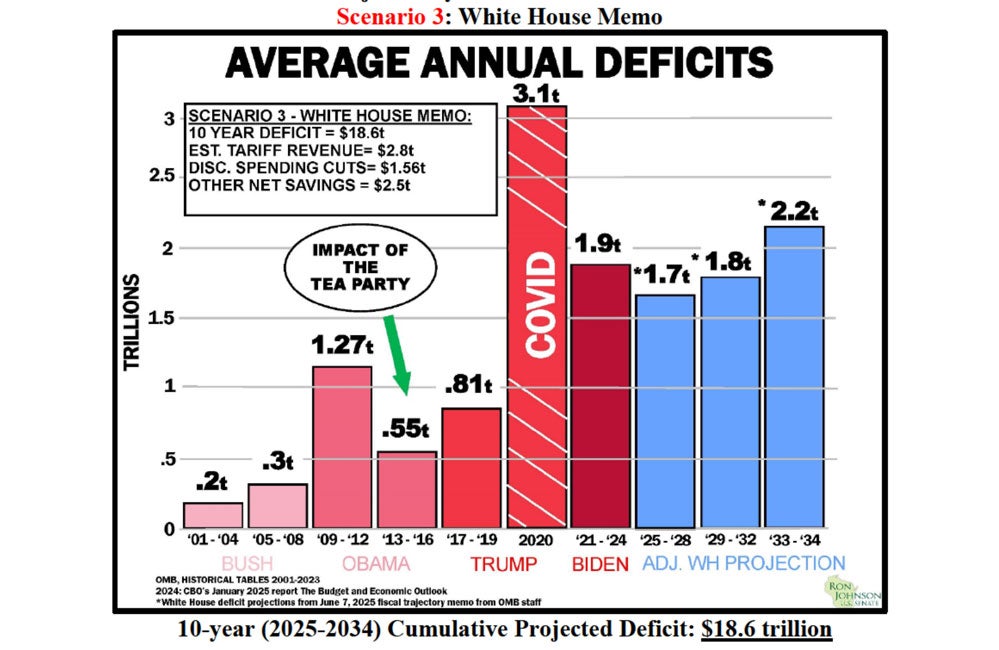

Johnson then includes a chart that imagines 3% growth as the White House projects, and includes a projected $2.8 billion in tariff revenue, as well as “1.6 trillion in discretionary spending reductions.”

This is based on a White House memorandum presenting the big, beautiful bill as a pathway to fiscal stability.

If true, this would bend the 10-year deficit all the way down to $18.6 trillion, but Johnson doesn’t buy these numbers.

“Tariffs are already being challenged in the courts, and if the administration loses these battles, it is doubtful Congress would act to keep sweeping tariffs in place,” Johnson writes. “Across the board, tariffs also represent a recessionary risk.”

He also says that there is no explanation for how the White House would achieve discretionary spending cuts.

Then, Johnson goes over the absolute best-case scenario for the “big, beautiful bill”—4% annual GDP growth.

This level of growth, “if even possible,” would achieve a $17.1 trillion ten-year deficit, “which would start bending the deficit trajectory down from $1.8 trillion annual deficits in FY 2025-2028 to $1.6 trillion average deficits in FY2033-2034.”

“Unfortunately,” writes Johnson, “the last decade experiencing real GDP growth of 4% or higher was 1960-1969.”

He adds, “the average for the first 25 years of this century has declined to only 2.21%.”

What is Johnson’s Point?

Johnson is defying the common GOP orthodoxy in his claim that tax cuts do not pay for themselves.

He argues that Trump’s 2017 tax cuts led to revenue losses which were only reversed during the 2020 pandemic recession, when stimulus packages and stimulative Federal Reserve tactics pumped money into the economy.

Johnson believes that nearly $1.5 trillion of revenue that has been brought in under Trump’s 2017 tax cuts can be attributed to inflation and “the economic impact of massive deficit spending.”

“The lessons for policymakers should be obvious,” he writes. “For liberals, stop trying to grow government by punishing success: it simply does not work. For conservatives, tax cuts do not automatically pay for themselves. Some will, others probably won’t.”

His suggestion? Reevaluate tax law and enact spending cuts to pay for tax cuts which might increase deficits.

Johnson’s Alternative

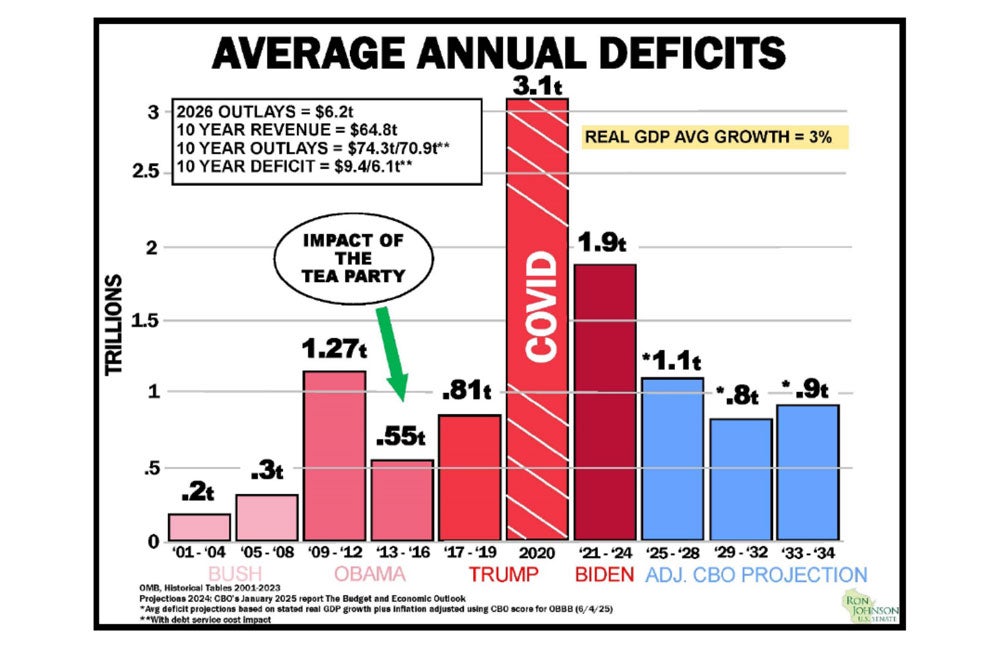

Johnson’s counterproposal to the big, beautiful bill is rather simple—reduce spending. More specifically, he proposes returning to a pre-pandemic level of spending, adjusted for inflation and population growth.

This would be 7.5% below the spending projected in 2025, and he imagines a situation in which this lower spending is maintained from 2026-2034.

He believes this would, assuming 3% real GDP growth, bring the ten-year deficit down to $15 trillion.

With his assumed impact on interest rates, he thinks the ten-year deficit could go even further down to $13 trillion, due to lower costs in debt service.

But Johnson doesn’t think this is even good enough. His true proposal is lowering projected spending from 2026 to 2034 by 14.6%—a colossal decrease in spending.

“Factoring in lower debt servicing costs, this scenario could potentially produce a balanced budget by 2034,” he writes, claiming the ten-year deficit would be just $6.1 trillion once debt service levels are decreased by falling interest rates.

“In normal times, a 14.6% reduction in federal spending would seem unthinkable, but these are not normal times,” Johnson says.

His estimates do not factor in the potentially deleterious effects of rapidly downsizing the federal government—which is itself a massive part of the economy.

He finishes with his practical suggestion—a DOGE-style dissection of the federal government.

“Since Congress has not yet taken the time to do the hard work of forensically auditing every line of federal spending and every one of the more than 2,600 federal government programs, we cannot expect to achieve a pre-pandemic level of spending in current budget reconciliation bill being debated. It will take a multi-step approach and a joint commitment by the President and both chambers of Congress,” Johnson concludes.

Asked by The Daily Signal if he thought these massive cuts could harm economic growth, Johnson acknowledged potential difficulties. ”I think that is a very legitimate concern about dramatically reducing government spending in a very short period of time,” he said.

“But again, on the flip side of that, the massive debt spending is harming growth as well. Secretary of Treasury Bessent is concerned about this. I had this conversation with him. So what you’re pointing out is a very legitimate concern.”